Common ways to dilute car park revenues when attempting to apply classical revenue management practices

Xavier ZAKOIAN

Jun 18, 2020

0

minutes

Introduction

Travel-related companies, such as cruise lines, car rental companies, hotels, tour operators and even some golf resorts, have been using revenue management techniques for decades. Recently, however, these principles have been introduced to the parking industry.This is mostly due to the remarkable shift of the sector, becoming more and more digital with the development of smart city concepts (including dynamic pricing policies). In addition, the implementation of parking pre-bookings, such as the on-line push of inventories that were not even digitalized before (hotel car parks) and the emergence of price comparators also played a role in this change.All these moves have led to a completely new picture of the parking industry with a competition context that has become ferocious, forcing the traditional actors (airports, urban parking operators, etc.) to become much more agile regarding their prices. There comes the question of the type of technique they should turn to.

Variable pricing is not dynamic pricing

There are several actors, mostly booking system providers, that propose − and claimed to have developed − revenue management solutions for the parking industry. What exactly do they propose? Mostly to help the parking managers pre-define situations where the prices will be automatically generated:

for example they enable them to set a rule like: “when the occupancy rate of the park is planned to be higher than 80%, the price is 20€/day”

or “when there are already 200 registered bookings for a given entry date, the prices should be raised by 10%”,

or any other sophisticated combination of weekday, period of the year, customer segment, entry time and why not weather conditions!The problem is that the system does not give any clue about the economic interest of such pricing rules!Such systems are sold as dynamic pricing solutions when they are variable pricing solutions (or “rule based” pricing solutions).

The Yield manager is therefore like Mickey mouse in the famous cartoon “The sorcerer’s Apprentice” using a technique that seems to help him in the beginning, saving him a lot of time and effort… but soon becoming a monster, out of any control: an infernal machine!

How indeed could anybody construct a sound pricing policy, based on manual pricing rules, that would still ensure revenue optimization and not… revenue dilution?

Occupancy optimization can lead to revenue dilution

In all sectors, occupancy rate is indeed the central core of a revenue management strategy, alongside with daily rates and revenue per available unit.

However, in the parking industry it is a false friend and, unfortunately, the most common mistake made by parking managers is to consider the occupancy rate as the core metrics for car park revenue management.

A false good idea: price upon occupancy rates

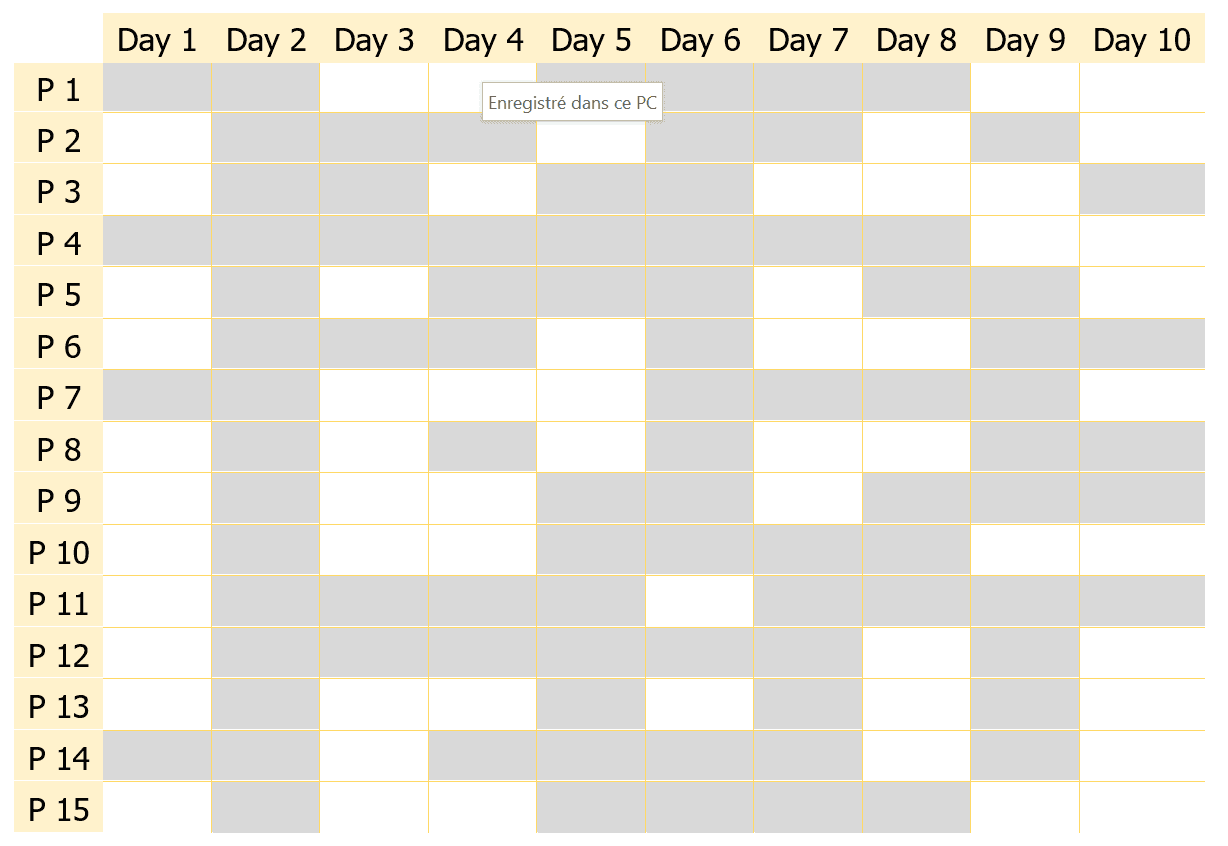

Let’s consider a simple example of 10 consecutive days (it could be hours for city car parks or weeks for airport long-term car parks) with an inventory made of 15 parking spaces.

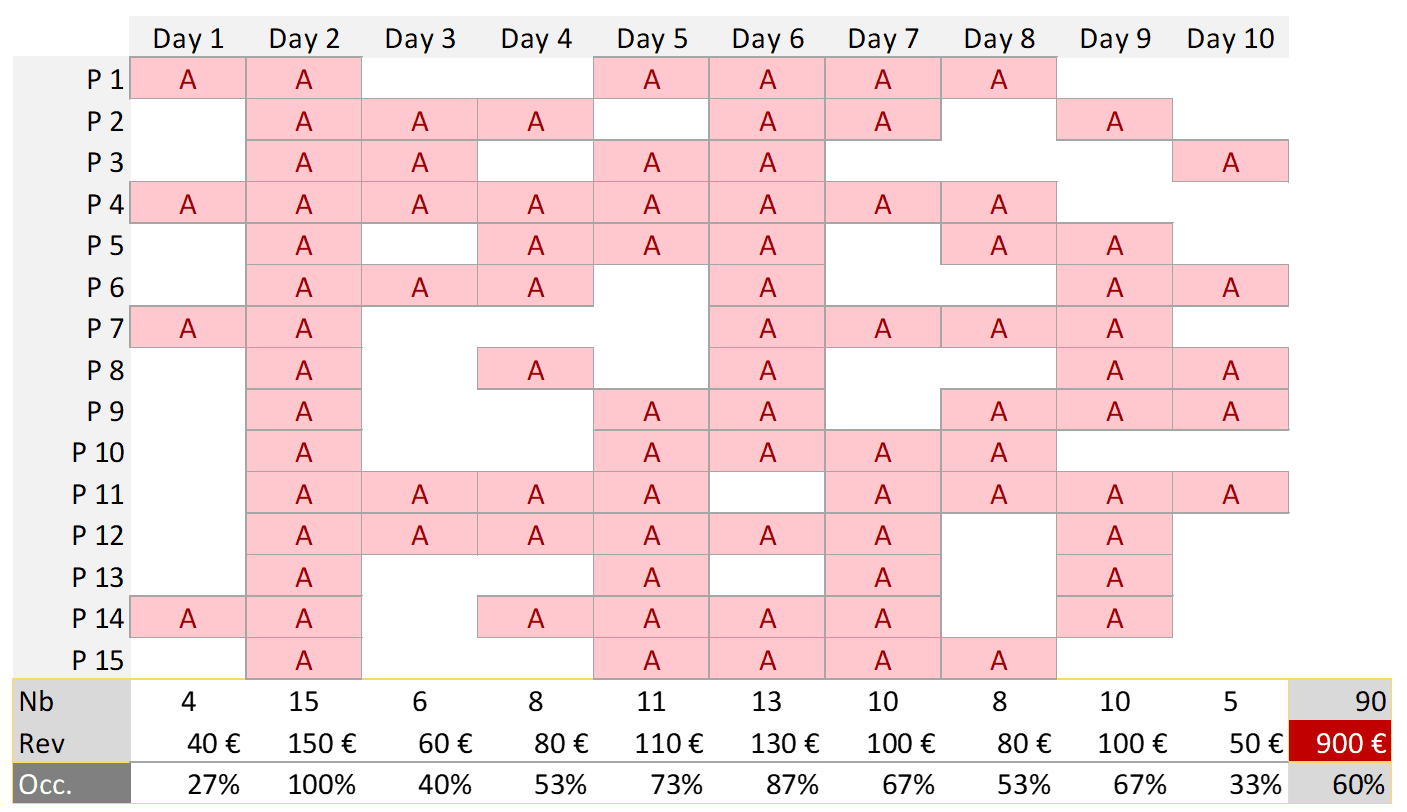

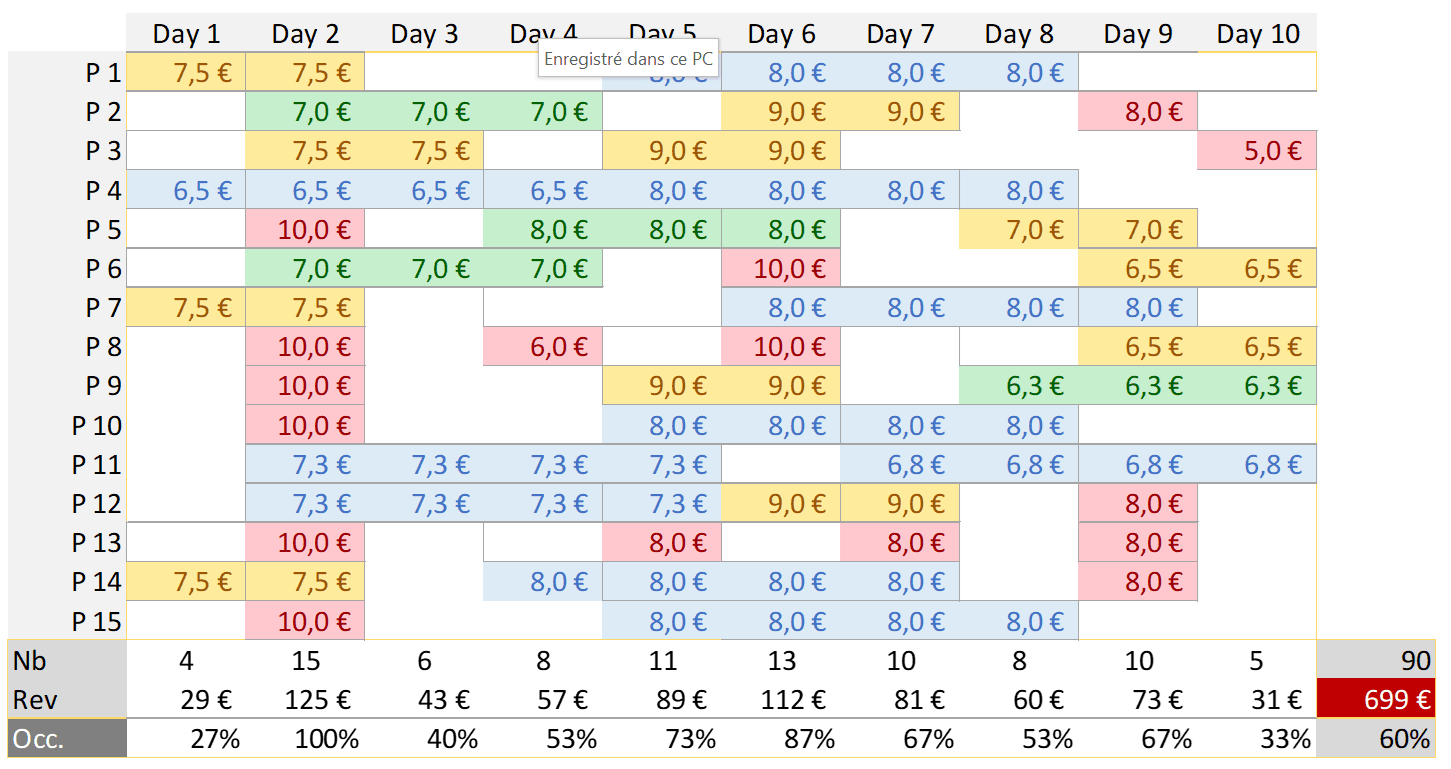

Let’s now imagine that, for the 10 coming days, the occupancy of the various spaces is forecasted as follows (the grey boxes correspond to occupied places):

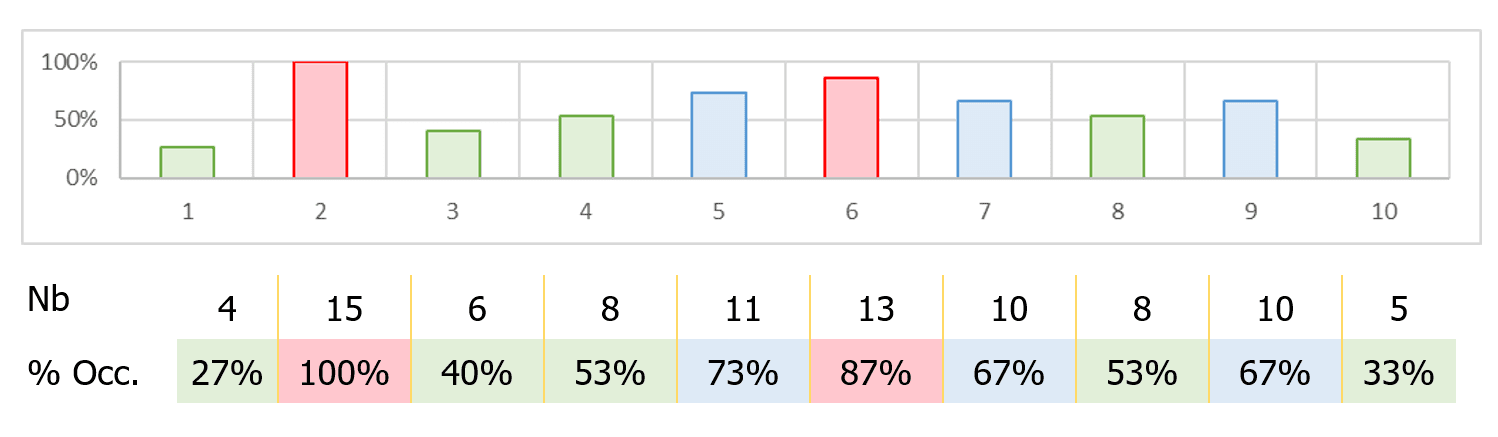

Which reads: the spot P1 is occupied on days 1 and 2, free on days 3 and 4, then occupied during 4 days until day 8, then free again the last two days. One can easily derive from this the following occupancy rates:

There are actors who apply a classical pricing routine like: “the higher the occupancy the higher the daily rate, and the lower the occupancy the lower the daily rate”. Doing so they deliberately ignore the “entry information” (the entrance time and length of stay) which is the core reason for which the inventory will indeed be occupied the way they forecast it.It is easy to show that such occupancy-based pricing policies are not optimal. A good illustration of this is that a given occupancy situation can be achieved in many ways, in terms of length-of-stay composition, each of them corresponding to different revenue results. Let’s imagine different demand patterns all leading to the same occupancy situation (the one described above).

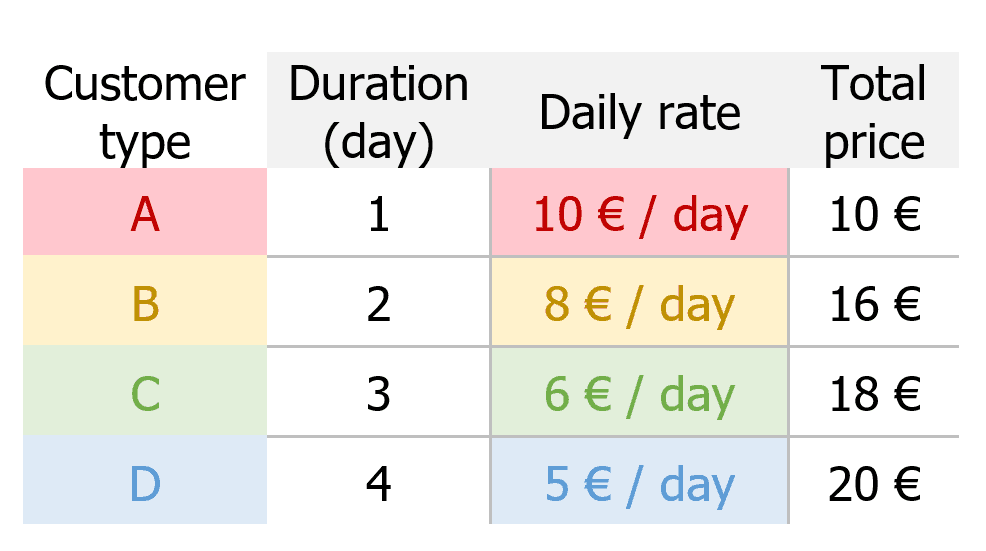

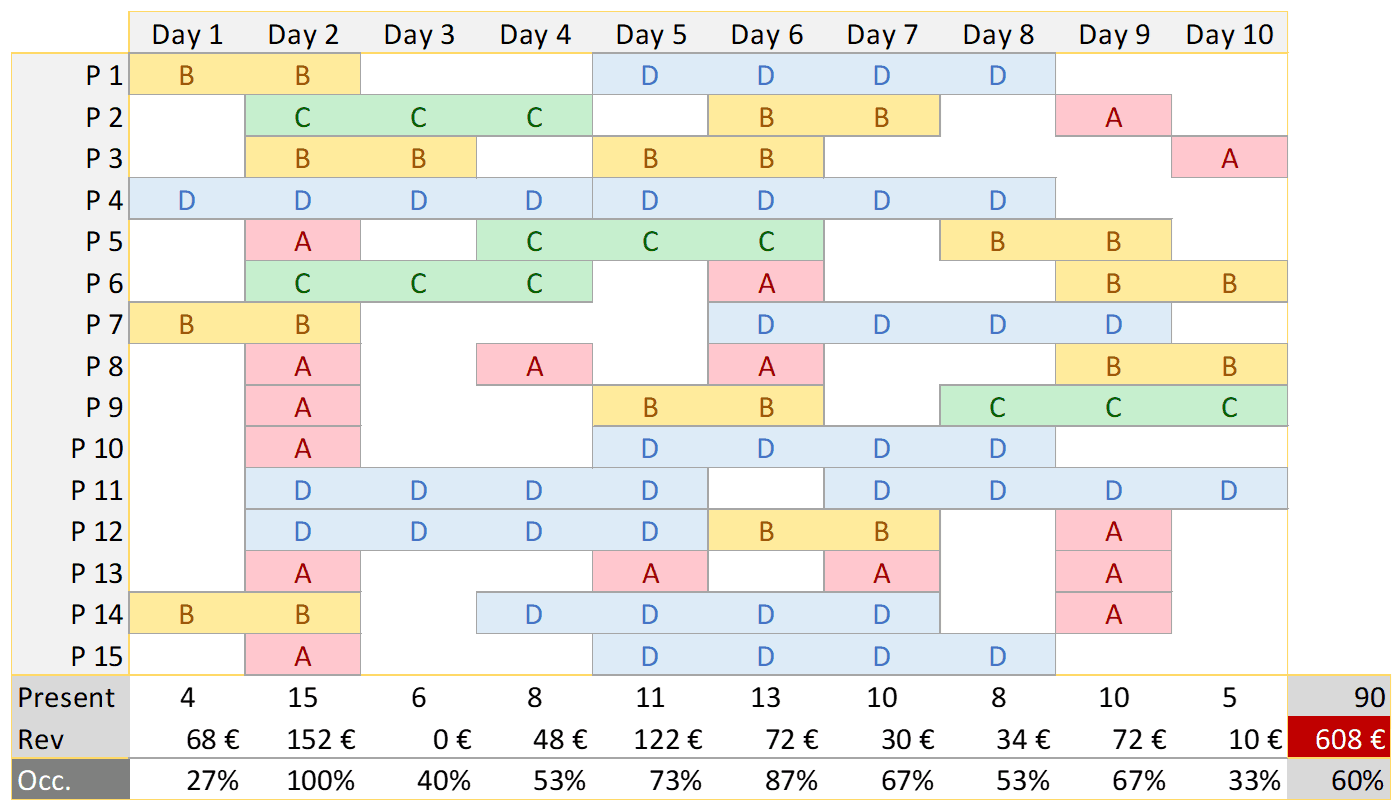

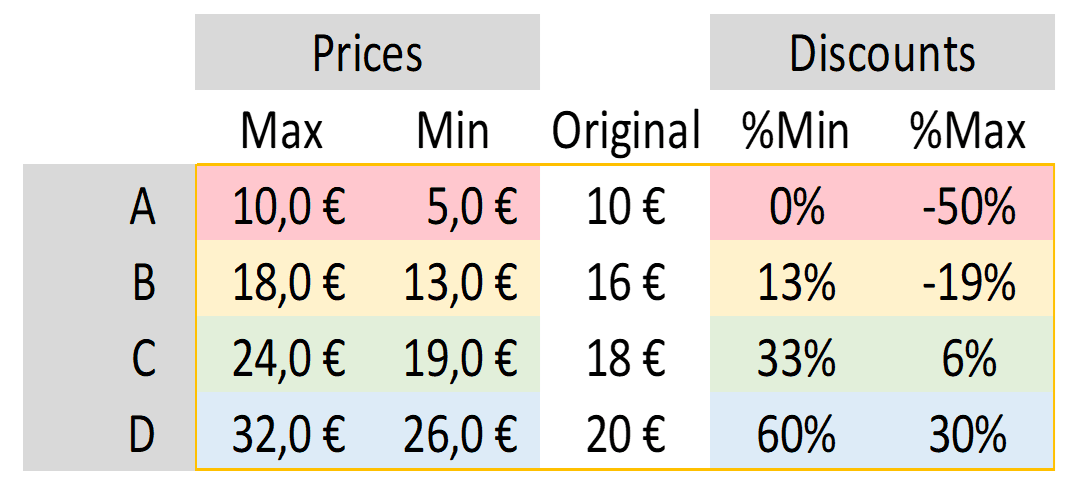

For example, let’s imagine, that people can book for only 4 types of stay: one-day, two-day, three-day or four-day stays. Moreover, let’s state that a standard price for each length of stay applies:For example, a one-day stay, type “A”, will correspond to a global revenue of 10€ with a daily rate of 10€.A four-day stay, type “D”, will correspond to a higher global revenue, 20€ but a lower daily rate: 5€.

Situation 1: The extreme following pattern, for example, corresponds to the occupancy situation described earlier but with only short-stay tickets:It corresponds to only one-day vehicles (type “A”) entering the car park. The global expected revenue would be 900€ (90 one-day tickets rated at 10€/day).

Situation 2: Another equivalent situation in terms of occupancy is the following:In this case, the same occupancy is reached thanks to various lengths of stay: for example place P8 is occupied in days 2, 4 and 6 by 3 one-day stay vehicles (“A”) and then later on day 9 and 10 by one two-day stay vehicle (“B”), entering in day 8.The result in terms of revenue is radically different: 608€.

With this simple illustration, one sees that the same occupancy situation can lead to very different revenue results. Can one still consider drawing its pricing policy upon the sole occupancy rate information?Well, some techniques have still developed, answering yes to the latter question. It is not rare indeed to see either software providers, pricing consultants or car park managers propose to apply the concept “the higher the occupancy the higher the daily rate, and the lower the occupancy the lower the daily rate”.

Pricing based on occupancy rates: a let’s cross the fingers strategy!

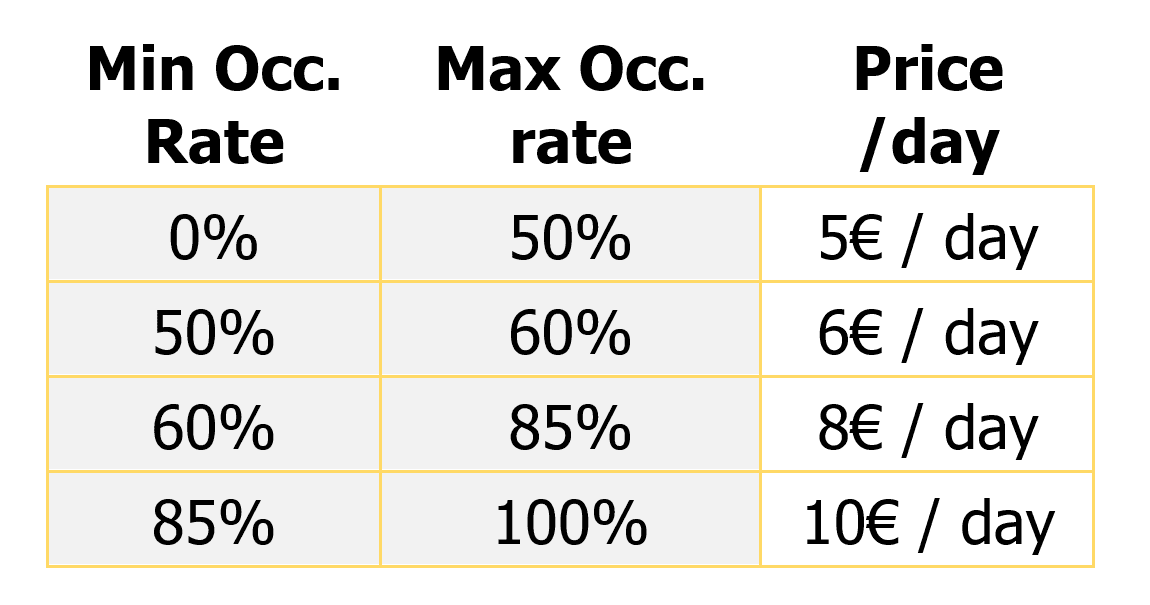

Let’s see to which results such a pricing policy can lead, assuming that the daily rate depends on the forecasted daily occupancy rate (it could be at hour level, but the principle is the same). For a booking request that would concern more than one day, the dynamic price would be the sum of the daily rates for the days of the requested stay.

Let’s imagine the following dynamic pricing policy based upon occupancy:Which reads: for an occupancy rate between 60% and 85% the daily rate to apply will be 8€/day (irrespective of the length of stay of the vehicle), whereas for an occupancy between 85% and 100%, the daily rate will be 10€/day, etc.

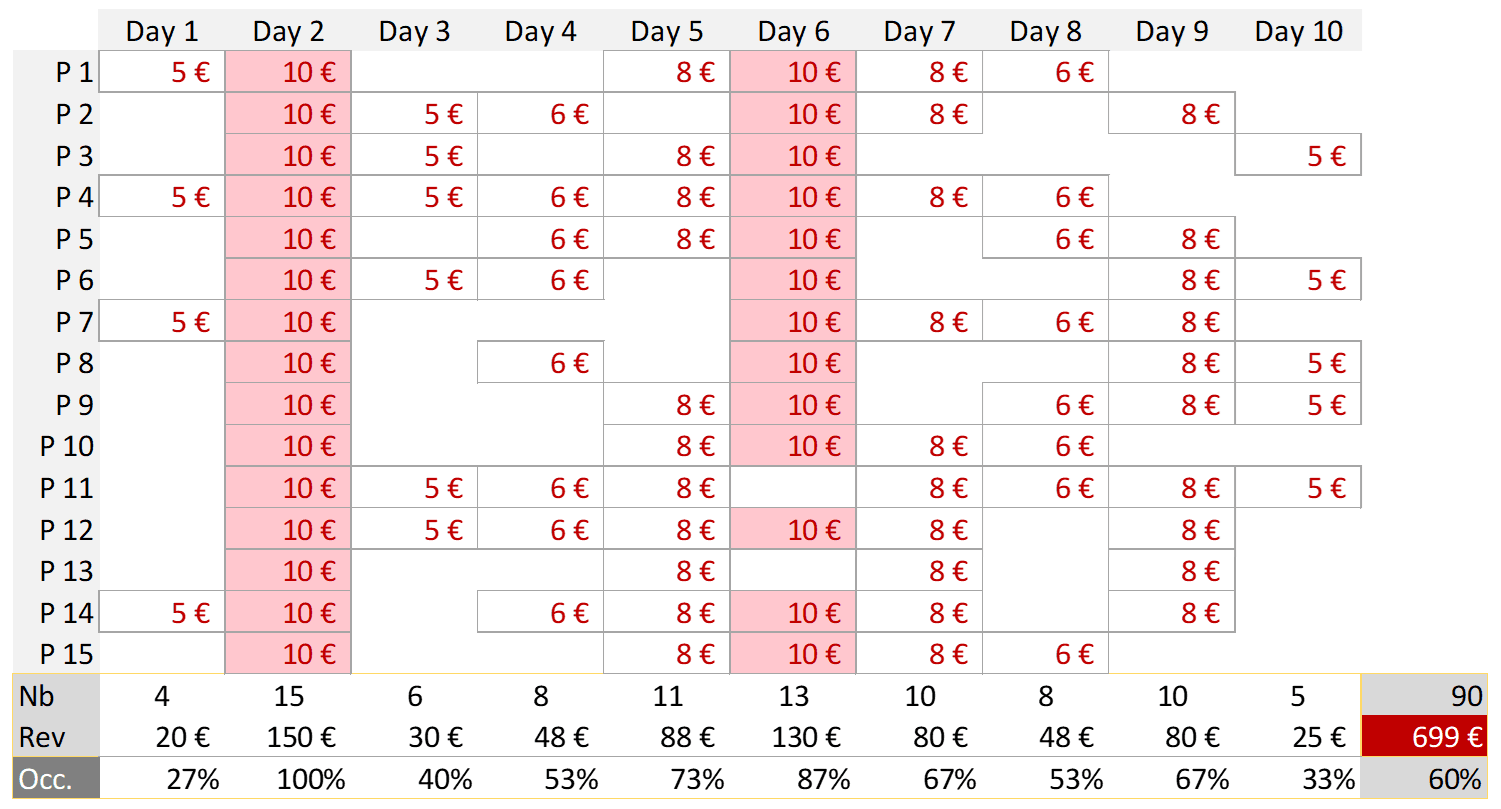

Let’s see what it gives for the vehicles of the situation 1.

The following table shows the various daily rates that would be demanded for each individual “A” ticket (in situation 1, only one-day tickets are observed).

Only on days 2 and 6 (depicted in red, in the below chart) will the rates be the ones corresponding to a normal one-day ticket. For the other days, discounts (up to 50%) will be applied in the hope that volume will compensate for revenue dilution.

Very likely to lose money! With such a pricing policy, the revenue (without volume compensation) is 699€.Let’s see what happens for the vehicles of situation 2:

The chart shows the daily rates asked for each customer type, considering the days they would “cross” and their associated daily rates.

For example, the 2-day ticket (type “B”) entering on day1 and parking in place P1 will pay 5€+10€ (the daily rates calculated by the occupancy-based pricing policy) which corresponds to an average daily rate of 7,5€ (and a global revenue of 15€).

The global revenue is therefore the same as in situation 1 (as the occupancy is constant and prices are based on occupancy), which is clearly not normal as the market demand is completely different (different entries per length-of-stay segment).One can easily see that the prices proposed to the various customer types strongly differ from one day to another:

For example, the “D” tickets will sometimes correspond to a global value of 32€ (like the one entering on day5 in place P15) and some other times to a global value of 26€ (the one entering on day1 in place P4), while the original value is 20€ for 4 days of stay.

This raises many questions, such as:

How can one be reasonably sure that when the requested price is higher than normal (by “normal” we mean: “as observed in the past for the same length of stay”) there will not be any customer refusing the higher price?

How can one be reasonably sure that when the requested price is lower than normal, the volume will compensate for the daily rate?

There is no solid foundation for such reasonings and the simple fact that a same given occupancy situation corresponds to so many different possible length-of-stay combinations should be an alert for those car park managers willing to adopt such risky pricing rules.

Note that the danger of such dynamic pricing polices is not related to the level of discount or surcharge applied for a given occupancy situation, but to the fact that it is only based on occupancy. Again, there is no reason that the two completely different demand patterns depicted above, should lead to the same revenue optimization results, just because they correspond to the same occupancy situation.

The way to optimize parking revenues clearly lies in other heuristics, not ignoring the length-of-stay demand patterns and capable to find the optimal combination between them all.